Federal Tax Levy

If you have received a “Notice of Intent to Levy” from the Internal Revenue Service (“IRS”), do not fear, you have options. You may be asking, what is an IRS levy? What are the IRS’s levy options? How long do I have until the IRS seizes (levies) my property? How do you stop a tax levy? This article provides the framework for answering these questions and provides practical tips for dealing with an IRS levy.

What is a levy?

A tax levy is an administrative means of collecting outstanding tax liabilities by seizing or taking your property. The IRS makes millions of levies per year. A common example of a tax levy is when the IRS issues a bank levy to seize cash in your checking or savings accounts. The IRS may also levy on your wages through a process called “wage garnishment.” The IRS can seize and sell your car, boat, or house.

A tax levy can be financially disastrous. Fortunately, if you have received a collection notice from the IRS, you have options to stop the levy. But, it is very important to take immediate action.

Accordingly, it is extremely important to maintain adequate records to substantiate the accuracy of your return—and it is required by law under I.R.C. § 6001. If you have not maintained adequate records, and the IRS has instituted a tax audit, there are other options to substantiate the items on your return.

Practice Pointer: If you have an outstanding federal tax liability, and you have not made arrangements with the IRS to pay back your tax liabilities, the IRS may start to seize (levy) your property. The IRS will notify you of its intent to levy through a series of notices. Do not ignore these notices. As with most collection alternatives, the earlier in the process that you make arrangements with the IRS to settle your tax debt the better.

Tax Levy Prerequisites and IRS Notices

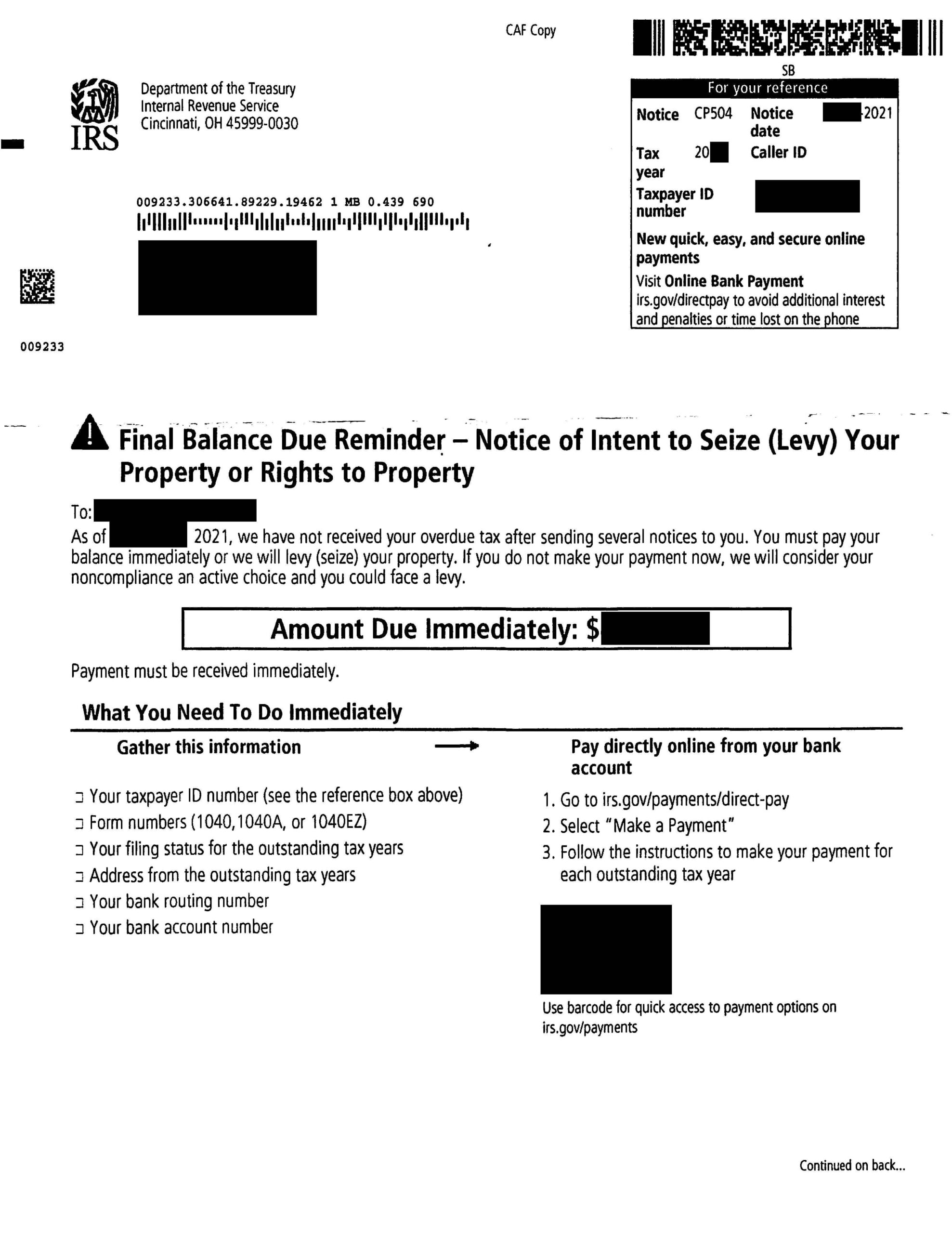

By regulation, the IRS must meet certain requirements prior to a tax levy. The IRS must first make an assessment of the tax and send a Notice and Demand for Payment. If you do not pay your tax liability after 10 days of the notice, the IRS will secure a Federal Tax Lien, and then begin the levy process. See Reg. 301.6331-1(a). Before your assets are levied, the IRS will send you a series of increasingly demanding notices. Individual taxpayers normally receive four notices prior to a levy (businesses normally received two).

The first notice an individual receives is a CP501 Notice (Notice and Demand for Payment), which is issued when the tax is assessed. The second notice is sent out about six weeks later, a third notice is sent about six weeks after that, and then the Final Notice of Intent to Levy and Notice of Your Right to a Hearing. The final notice must be sent at least 30 days prior to the levy and must be provided to you in person, at home, at your place of business, or by certified mail to your last known address.

Practice Pointer: Once you begin receiving threatening notices from the IRS, you are strongly encouraged to contact the IRS to work out a payment option. You should not wait until the final notice.

Appeal to Avoid the Tax Levy

After you receive the Final Notice of Intent to Levy and Notice of Your Right to a Hearing, you have 30 days to file for a Collection Due Process (CDP) hearing. The request for a CDP hearing is made on Form 12153. A CDP hearing is a formal hearing with a Settlement Officer in the IRS Appeals Division where you have the opportunity to appeal the collection division’s determination that the levy was appropriate under the circumstances.

At the CDP hearing, you or your representative will argue for an installment agreement, offer in compromise, or another collection alternative in lieu of the levy. You also have the right to request an equivalent hearing or to appeal through the Collection Appeals Process (CAP) pursuant to I.R.M. 5.10.1.7.3.

Columbus, Ohio Tax Levy Representation

IRS Levy Attorney in Gahanna, Ohio

Porter Law Office, LLC is an AV Rated boutique tax controversy law firm that assists taxpayers with resolving tax debts with the IRS. If you have received notices from the IRS threatening a tax levy, you should have enough information to answer the question “what is a levy?” The next step is to take action and avoid the tax levy. Columbus, Ohio tax lawyer Matthew R. Porter, J.D., LL.M. assists taxpayers with avoiding tax levies and requesting CDP hearings with the IRS.